net investment income tax 2021 form

In addition families can use pre-pandemic. Printable 2021 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2021 tax tables and instructions for easy one page access.

Easy Net Investment Income Tax Calculator

Individuals who have for the tax year a MAGI thats over an applicable threshold amount and b net investment income must pay 38 of the smaller of a or b as their NIIT.

. Income Tax Return for Estates and Trusts Schedule G Line 4. For tax years beginning on or before Dec. 1 It applies to individuals families estates and trusts but certain income thresholds must be met before the tax takes effect.

If the amount on your 2021 Federal Form 10401040-SR1040NR line 18 is zero and the Net Investment Income Tax from line 17 202 1 Form 8960 is also zero STOP enter zero on Line 15 below. 20 2019 the excise tax is 139 of net investment income and there is no reduced 1 percent tax rate. The 38 Net Investment Income Tax.

Go to wwwirsgovForm8960 for instructions and the latest information OMB No. If the investment income needs to flow to the Form 990-T select the arrow beside Business Code Mandatory for Form 990-T and enter or select the appropriate business code then enter the amount. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

Since 2013 certain higher-income individuals have been. 2021 Form 8960 Form 8960 Department of the Treasury Internal Revenue Service 99 Net Investment Income Tax Individuals Estates and Trusts Attach to your tax return. You can print other Federal tax forms here.

1545-2227 2021 Attachment Sequence No. This tax must be reported on Form 990-PF Return of. 72 Names shown on your tax return.

Those rates range from 10 to 37. According to an april 28 2021 congressional research service report the joint committee on taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-incomehouseholds see congressional research service the 38 net investment income tax. Printable 2021 federal income tax forms 1040 1040SR 1040SS 1040PR 1040NR 1040X instructions schedules and more.

This form is to be included with the Form 1040 and Form 1041. Do not include sales tax or any foreign income taxes paid for which you took a credit. As you know the net investment income of individuals estates and trusts is taxed at the rate of 38 provided they have income above the statutory threshold amounts.

Tax more commonly referred to as the net investment. We earlier published easy NIIT calculator. How is the NIIT Reported.

This is the detailed computation of the Net Investment Income Tax which is regulated by section 1411 of the Internal Revenue Code. 4 2021 the court held that the US. Subject to a 38 unearned income Medicare contribution.

Generally net investment income includes gross income from interest dividends annuities and royalties. Include state local and foreign income taxes you paid for the tax year that are attributable to net investment income You can determine the portion of your state local and foreign income taxes allocable to net investment income using any reasonable method. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net investment income or 350000 250000 100000 of modified adjusted gross income yielding an NIIT of 100000 3 8 3800. The statutory authority for the tax is. Future Developments For the latest information about developments related to Form 8960 and its instructions such as legislation.

April 8 2021 756 AM. Tax Treaty with France did not change the general rule that the foreign tax credit cannot offset the NIIT. You can download or print current or past-year PDFs of Form 8960 directly from TaxFormFinder.

The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. FS-2022-30 May 2022 This Fact Sheet updates the frequently asked questions FAQs for Tax Year 2021 Earned Income Tax Credit FS-2022-14. Married Filing Jointly or Qualifying Widow er is 250000.

Print This Form We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960 fully updated for tax year 2021. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Married Filing Separately is 125000.

For most US individual tax payers your. The total of the state local and foreign income taxes that you paid for the current tax year is entered on line 9b of form 8960. SOLVED by Intuit Lacerte Tax Updated July 30 2021 Use Screen 23 Other Investment Income to enter investment income.

More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. The estates or trusts portion of net investment income tax is calculated on Form 8960 Net Investment Income TaxIndividuals Estates and Trusts and is reported on Form 1041 US. The net investment income tax is reported on Form 8960.

All About the Net Investment Income Tax. Taxpayers use this form to figure the amount of their net investment income tax NIIT. The applicable threshold amount is based on your filing status.

For tax years beginning after Dec. More people without children now qualify for the Earned Income Tax Credit EITC the federal governments largest refundable tax credit for low- to moderate-income families. Enter only the tax amount that is attributed to the net investment income.

For the most part interest income is taxed as your ordinary income tax rate the same rate you pay on your wages or self-employment earnings. The Net Investment Income Tax. You wont know for sure until you fill out Form 8960 to calculate your total net investment income.

20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. Updated for Tax Year 2021 January 21 2022 0505 PM OVERVIEW If you earn income from any of your investments this year you may have to pay the net investment income tax in addition to the regular income taxes you owe.

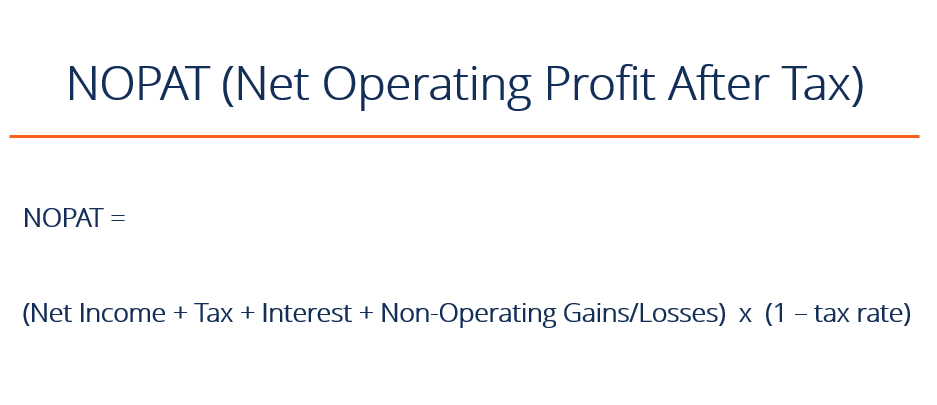

Nopat Net Operating Profit After Tax What You Need To Know

Like Kind Exchanges Of Real Property Journal Of Accountancy

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

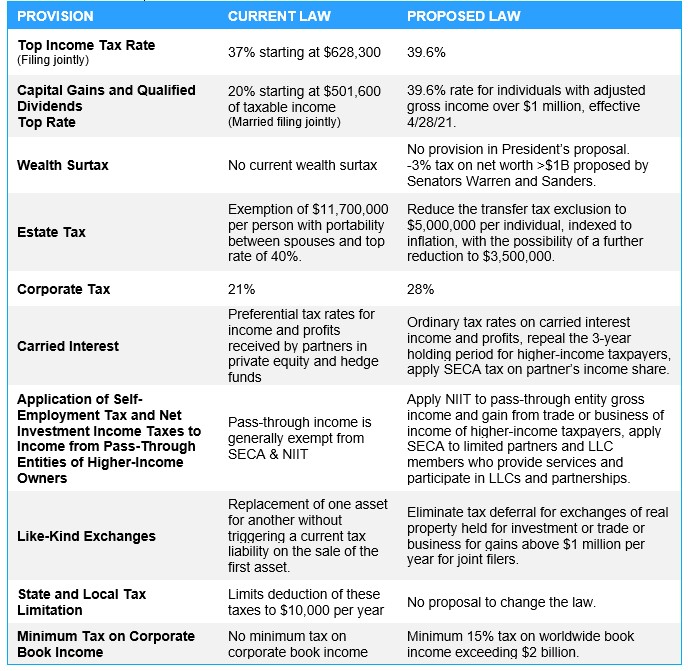

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

Free Income Tax Filing In India Eztax Upload Form 16 To Efile Income Tax Filing Taxes Income Tax Return

Tax Facts On Individuals Ebook Business Ebook Small Business Accounting Facts

Net Investment Income Tax Schwab

Sources Of Personal Income In The United States Tax Foundation

What Is Investment Income Definition Types And Tax Treatments

Avoiding The 3 8 Net Investment Income Tax Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

What Is The The Net Investment Income Tax Niit Forbes Advisor

1 Form 1 Extension Here S What Industry Insiders Say About 1 Form 1 Extension In 2021 Tax Extension Income Tax Return Sayings

Net Investment Meaning Importance And Calculation Scripbox

Pin By Ananya Sharma On Places Download Resume Tax Rules Income Tax

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)